The Radical Portfolio Theory

As the 60/40 portfolio falters, investors must move beyond conventional risk taking to embrace a new approach that balances compliance with systemic norms and resistance to global economic fragility

The traditional 60/40 portfolio split—60% in equities for growth and 40% in bonds for safety—has reached the end of its relevance. Recent market turmoil has revealed the cracks in this half-century-old strategy, as correlations between stocks and bonds collapse. To thrive in a hyper-financialized world, investors must rethink their approach, moving beyond risk-on/risk-off mentalities toward a portfolio that embraces both compliance with the status quo and resistance against systemic fragility.

Part I: The Death of Traditional 60/40

At the end of 2022, we witnessed a breakdown in the 60/40 portfolio: the S&P 500 was down 18%, and Treasuries also fell by 13%, offering no protection. In 2023, the trend continued, with the equity-bond correlation starting and ending the year at +0.4. This has remained true through 2024. Don’t just take my word for it—look at the correlation chart below, which illustrates this breakdown:

For more than half a century, equities and bonds were considered the foundation of diversification. To understand what has failed, we first need to review the original song-tale of this world view. Traditionally, equities (the 60%) were thought to offer "growth," while bonds (the 40%) provided "safety." This allocation was designed to optimize a balance between “risk-on” and “risk-off” strategies. The thinking was that, since the world typically embraces risk, you should be mostly optimistic. However, the 40% allocation to bonds was there to hedge against the inevitable moments when the markets took a downturn, offering an inverse correlation as protection.

This view rested on three assumptions:

Risk equals “growth.” Specifically, this was growth fueled by real productivity gains—whether through top-line growth, margin improvements, or corporate financial engineering.

The social covenant of Treasuries provides safety. Bonds represented stability because of a deeply held belief that falling rates signal a recession. This was almost a self-fulfilling prophecy, as institutional actors would step in to "fix" the present by manipulating time.

The biggest assumption it makes, however, is the very US sovereign creditworthiness itself. 60/40 doesn’t even feign an attempt to rationalize that the whole model breaks if the foundational assumption that US bonds remain “risk-free” is challenged. The US government's ability to repay debt is unquestioned.

Now, in 2024, nearly 75 years after Harry Markowitz proposed Modern Portfolio Theory, it’s time to revisit these assumptions, starting with the last one: US sovereign creditworthiness.

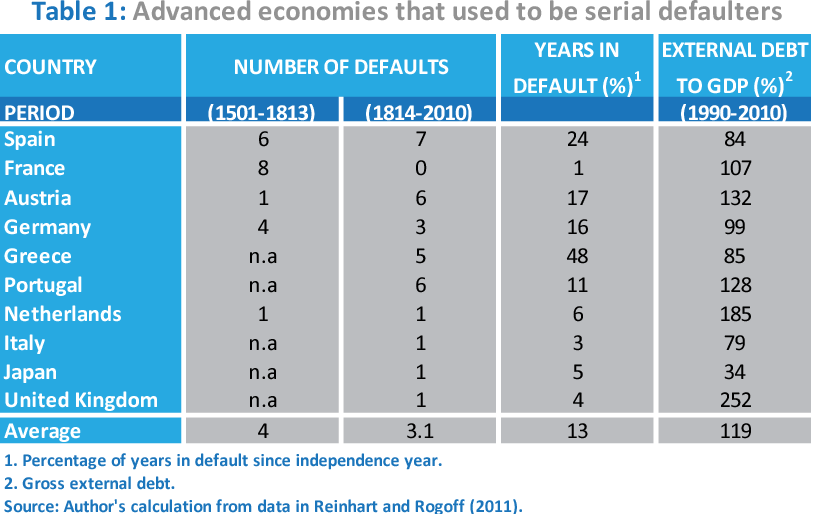

First, it must be acknowledged that it is a significant historical anomaly that the US debt has not defaulted in modern history. One of my favorite books, “This Time is Different: Eight Centuries of Financial Folly” by Carmen Reinhart and Ken Rogoff provides extensive analyses of sovereign defaults over the past 800 years (and it may amuse readers to know that several US states defaulted on their bonds in the 1830s): France defaulted 8 times between 1500-1800, as did Spain, Greece, Portugal etc. Russia defaulted in 1918 (and again in 1998), Germany in 1932, Austria & Hungary in 1931. The reason I purposely only highlight European countries here is to dispel the notion that sovereign defaults is a Latin American/Africa/Asian phenomenon; it’s not. And while the US has never defaulted, the mockery of the debt ceiling debate is the repeated satire of the current situation in which the world’s lifeline rests. So we must start by wondering about this assumption quite seriously, and make room for some disbelief.

How we approach the future in such a scenario (ie. what is the “60%” that provides in the general state of affairs, and the “40%” that hedges for the unconventional) demands that we must move away from the risk-on/risk-off mindset based on a “growth” and “safety” mindset. The answer to this trillion dollar question will serve as the blueprint for all investors in navigating the next fifty years of a hyperfinancialized world where the market is no longer a function of the economy, but the economy is the function of the market.

The perceived safety in bonds, particularly US Treasuries, which is closely related to the above bullet, is the other factor to monitor but through a slightly different lens. Observe our trade partners and external debt holders and how they are navigating for the future: here, we can observe irrational behavior by trade partners who hoard the greenback and its associated yields for which there is scarcity by insatiable demand. This exposes the dual mandate of the dollar which economists often noted as the end game of the Triffin dilemma. This creates a world where rates are not actually a function of a domestic policy and the conditions of the US economy itself, but an output manipulated by other global players who are gaming the “manipulation of time,” most often done under the guise of a loosely defined need to support global productivity ie. population growth. Observe the lack of such thing worldwide, and therefore the likelihood of zero interest rate world becoming more inevitable (which is already observable via Japan who is ahead of the curve in financial repression) in which case without negative rates, one’s asymmetric positioning is all to the downside.

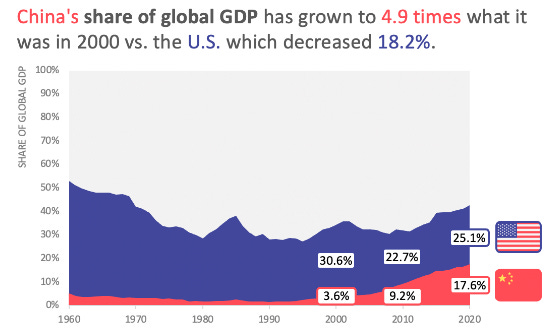

which brings me finally, to “growth.” While growth can be measured as originally described at the microeconomic level, there is another prevailing view from the school of macroeconomics. In Econ 101, one is taught that capital-letter “Growth”, or GDP, is measured as C+I+G+(X-M). This “expenditure approach” leverages every possible financial manipulation available on the monetary base, as any elementary school student would wonder: how is government spending considered growth on the asset/liability double ledger? Under this definition, “growth” starts to look more like “liquidity.” I’ve posited before that the global economy is a giant carry trade. I posted prior here on this. In addition, this man-made “Growth” (aka increasing liquidity) figure is just mumbo jumbo to hide the only thing that really matters in recent history: China. Whereas the Fed injects liquidity to drive the financial markets, it is the PBoC whose liquidity injection drives the world economy and commodities markets. In other words, the 60% allocation to global equities is driven by a close-ended authoritarian government of the world’s first/second most populous nation.

How we think about the future in this scenario, ie. what is the “60” that we want to assume is the general state of affairs, and the “40” that you want to allocate to hedge for the unconventional, demands that we might move away from risk-on/risk-off mindset from a “growth” and “safety” mindset. This is the trillion dollar question that will serve as the blueprint for all investor’s to navigate the next fifty years of a hyper-financialized world where the market is no longer a function of the economy, but the economy is the function of the market.

Part II: A New Manifesto

To answer this question, I propose the Radical Portfolio Manifesto. We must first reinterpret the social contract of the world order - moving beyond the covenant of portfolio allocation that is anchored in traditional notions of "risk-on" and "risk-off" centered around “Growth.” Instead, we should focus on what truly matters: identifying the most indisputable core elements in investment optimization that drives the value of genuine diversification, with the uncompromising goal of wealth preservation. In this context, I emphasize five key principles that can guide us in advancing this agenda for the post-modern future:

First, we must accept that there is no absolute truth in social sciences like economics. We believe the opposite of misinformation is not truth, but rather state-controlled information - where narratives are crafted to align with authority, rather than being inherently true or false. One person’s martyr is another’s terrorist; one person's colonization is another’s modernization; one person’s labor is another’s capital; one person’s insurance is another’ speculation - and so on;

We believe the world is becoming more centrally managed than ever before, yet with growing unease and fragility in its interconnectedness alongside the meteoric rise of HPC-driven autonomous decision models - in money, but also in fundamental human rights. Therefore we must hedge against this artificial centralization by seeking a custody model outside of that - one that provides self-determined autonomy;

We believe that today’s monetary regime is fundamentally broken. It is no longer driven by rational economics of the “invisible hand,” but by large cross-border flows of sovereign actors that overwhelm free and efficient markets. These cross-border flows, more influential than trade-balances, are fundamentally destabilizing and abnormal (see my post here about the various historical scenarios over the last 100 years). This underscores the increasing importance of ‘scarcity’ in a time of abundant manufactured liquidity;

We believe that most liquid financial assets today represent the abstract monetization and manipulation of time. Therefore we must rethink the true nature of permanence- where time itself cannot be the source of returns. We need something that doesn’t spoil by Mother Nature’s hand and requires no man-made assistance to maintain its value through eternity;

Which brings us back to the beginning: if there is no absolute truth in social sciences, then the truth we must adhere to is personal agency, plurality, and reciprocity (see Nate Silver’s On the Edge for more details). In a world driven by information asymmetry, we believe truth is best understood with a probabilistic mindset as opposed to a deterministic mindset. Remember Bots are deterministic; AI is probabilistic.

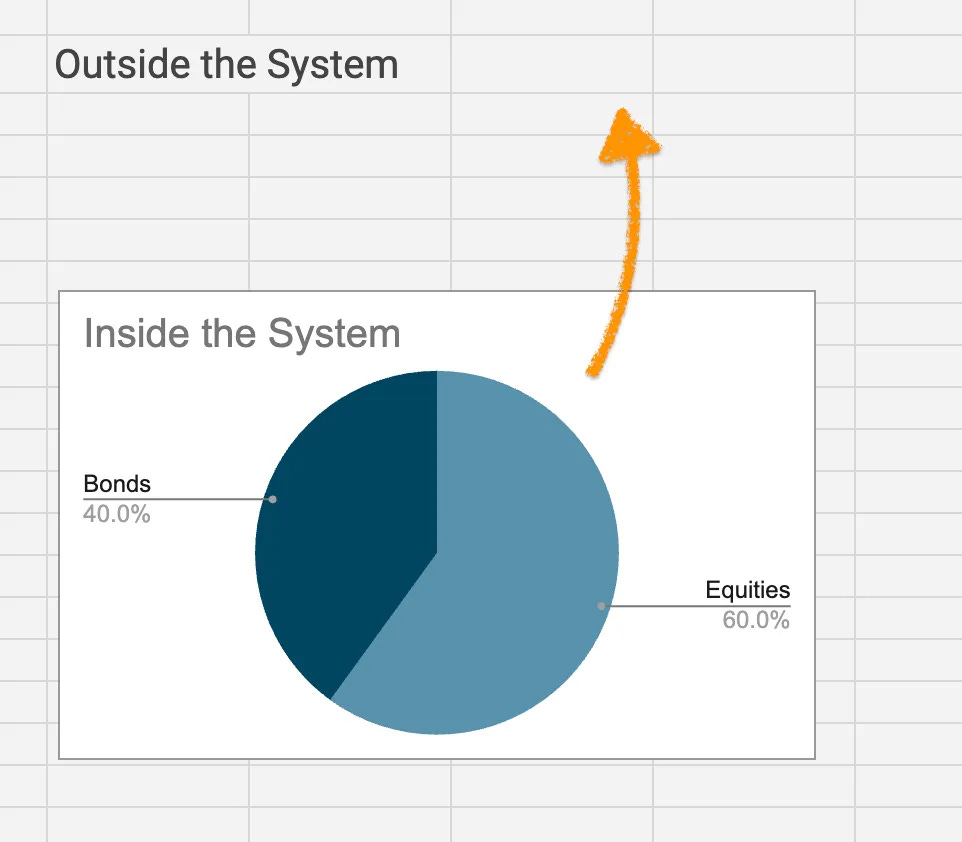

In this framework, it becomes clear that the traditional 60/40 portfolio of stocks and bonds is no longer relevant. In that scenario, you’ve already failed, as you're holding 100% centrally planned assets whose custody and value is manipulated by cross-border flows that influence global liquidity, disconnected from real economic productivity.

We must break free from this paradigm. But how?

Part III: The “Radical Portfolio”

To break free, we first must accept that asset classifications being defined as equities, bonds, commodities, etc. are useless as correlation increases between all financial assets (and even when correlation decreases, I would argue that the correlation of financial manipulation is increasing anyway). Acknowledging the definition of “Growth” itself has fundamentally changed, portfolio theory is no longer about productivity as it is more about liquidity, and we need to first get out of the box of hyper-financialization itself.

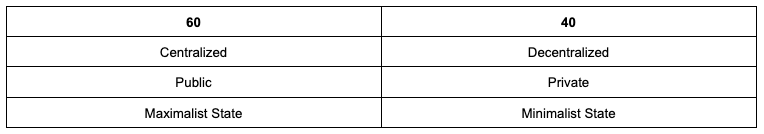

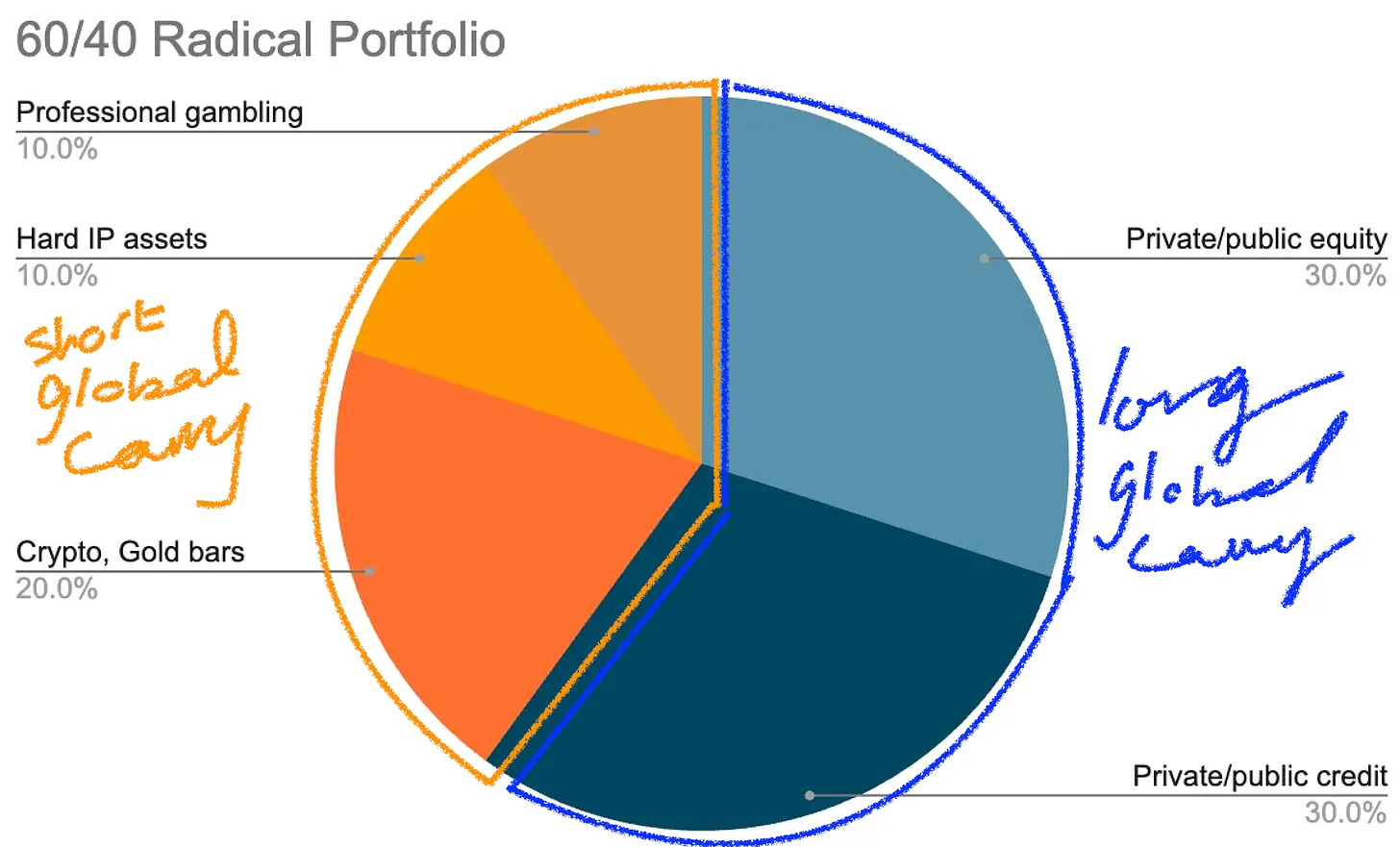

Only once you are outside of this box, the appreciation for true optionality increases dramatically, where one can consider 60/40 approach in characteristics such as below:

Pondering whether there was a single word that could unify these concepts, I remembered my recent “X Spaces” that I hosted with Saleha Mohsin and Andrew Bailey (link here). This led me to my “aha” moment:

The Radical Portfolio’s core thesis is 60% Compliance / 40% Resistance.

To illustrate what this radical mindset means, we assess the foundational assumptions of different kinds of assets in the world that one can own as we seek to draw some heuristics out of their commonalities. Here I lay out how to categorize a few examples in such a schema:

If you own GLD (Gold ETF), that’s compliance - 60% bucket. If you own physical gold bars, that’s resistance - 40% bucket

If you hang valuable art on your walls at your home, that’s compliance - 60% bucket. If you own the same art held in tax-free freeports, that’s resistance - 40% bucket

If you own your primary residence, that’s compliance - 60% bucket. If you anonymously own a shelter offshore, that’s resistance - 40% bucket

What you find here is that at a high level, highly resistant assets are by definition likely to share attributes of being decentralized, scarce, and timeless. This is the radical way we must imagine portfolio theory. We must live our lives within institutions for the most part (60%), but we also need to live our private lives away from such institutions for it is not improbable that they may break during our lifetime, most likely in a fantastic way. To summarize this point, there is a wonderful quote from an author I love, Hernan Diaz who wrote the book “Trust”, where Ida Partenza’z father, an Italian anarchist, proclaims:

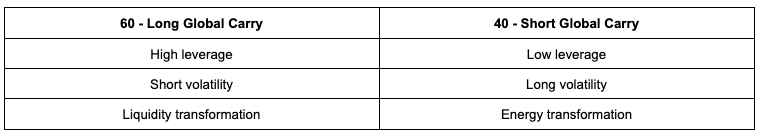

This transitions nicely to my next point, which is that the Radical Portfolio, by asset classification, can also be understood as 60% Long Global Carry / 40% Short Global Carry. Implementation and asset classification is not necessarily the same thing but there are enough overlaps; if we believe that equities and bonds participate in the same circular global carry trade, then the goal is to find an asset that is anti-carry which is likely non-compliant.

While a traditional carry trade is normally defined as a close-ended FX yield harvest trade, the bigger modern carry trade apparatus I speak of is far more reaching than that. Nonetheless, the core characteristics are the same: it is highly leveraged, short-volatility in nature, and it borrows liquidity from those that are low to reinvest in those that are high. The traditional 60/40 portfolio therefore is within the “60%” compliance allocation, and can also include assets like private equity, and private credit. The anti-carry asset therefore must be the opposite of all this:

In my view, the distinction between the “transformation of time” is the most elusive yet aspirational one. Today, the refinancing market is four times larger than the primary issuance market, a glaring red flag. As the carry trade transforms liquidity, the anti-carry asset must transform time. There are not very many assets that can do this in the world. And while we often default to thinking that the only way to manipulate time is through liquidity (ie. stealing from the young for the old), the first law of thermodynamics has another input: energy. A “40%” allocation within this construct can include investment expressions like AI or culture assets, poker/sports gambling income, biotech IP: these assets transform energy-intensive labor into income without leverage, and high payouts. Relatedly, I believe this will be the great unlock of “tokenization” en masse.

Polymarket represents one of these radical breakthroughs. It is an ‘energy transformation’ of someone’s labor towards financial productivity that is inherently long volatility. It is therefore ‘short global carry’ and ‘long resistance.’ Many assets fit this category, if you know where to look. Culture tokens, such as Hermes Birkin bags, are in the same category. So is the inevitable monetization of (your) data.

I've tried to write this post without mentioning crypto because I didn’t want it to become a crypto manifesto. For many crypto investors, the manifesto’s appeal should already be obvious and self-evident. My goal here was to help them see a broader opportunity without compromising their ethos. There are many esoteric assets in the world—both in the form of labor and capital—that can be decentralized, resistant, and scarce. One such example on a highly metaphorical level is children. In a world facing population decline, energy-requiring children, who are scarce, resistant to authority, and antifragile by their self-sovereignty, might be the greatest expression of the "40" allocation missing from your mental model—especially if they grow up to “change the world” (i.e., long volatility). Unfortunately, children aren’t timeless (or are they?).

That said, I’ll make one plug for Bitcoin: Being long scarcity might lead to illiquidity, but being long illiquidity doesn’t necessarily mean you’re long scarcity. Many institutional investors confuse this, so it’s worth repeating: For instance, being long private credit isn’t inherently more scarce or valuable than accessing abundant credit. Being long on OpenAI at $150 billion in a private round isn’t inherently more scarce than backing other brilliant entrepreneurs who will create more abundance.

Yet, there remains one asset in the world where scarcity and liquidity coexist seamlessly: a global asset that is both rare yet fungible. You know exactly which one I’m talking about. Now, it’s time to tell others—and to reimagine the 60/40 strategy in a way that truly prepares us for financial survival.