Do cross border flows influence trade balance, or vice versa?

History shows that this interconnected relationship is complex and unstable, but some recent periods can help drive conclusions about what to expect in the future. And crypto might play a bigger role

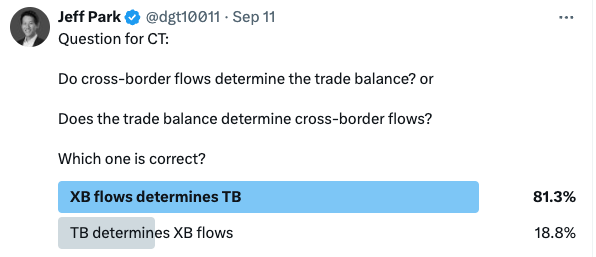

Yesterday, I asked on Crypto Twitter the following question:

I drew a few conclusions from the results:

My CT friends are really well-informed! I was surprised by the landslide vote for cross border flows (which I think is correct personally), and this gave me great confidence that crypto investors are perhaps better aware of global macroeconomics than the average American citizen. This is so great.

The question elicited my good friend David Lawant to recommend a book, which is always such a pleasure so that has now been added to my Reading List. The title of the book suggests that the answer to this very question might have implications about how to understand the winners and losers of today’s monetary system: who benefits when cross border flows champion? Who loses when trade balance takes the backseat? That’s why I think this is an important question to ask on behalf of the public conscience.

First, it's crucial to acknowledge that cross border flows and trade balance are indeed closely interconnected as few pointed out. For example, cross border flows can influence trade balance via capital flows; inflows of foreign capital can strength the country’s currency which in turn makes exports more expensive / imports cheaper. This, as we know, leads to widening trade deficit. The other source of cross border flows that crypto investors are natively familiar with are remittances. Money sent by individuals across border increase domestic consumption of imports, thereby affecting trade balance in return. The most blunt tool of cross border flows, however, is probably FDI; increasing FDI can boost domestic production capacity which increases export potentials.

In the other direction, it’s possible trade balance influences cross-border flows too. Trade surplus itself can lead to a country’s appreciation of its currency (except for China, which manipulates its fixings), and that in turn can attract foreign investments as the stronger currency itself becomes more appealing. Such might be the case of recent foreign investments in the US semiconductor industry via the CHIPS Act. Vice versa, a country with sustained trade deficit may lead to an increased need for more foreign borrowing, which leads to greater capital inflows as countries fund their current account deficit through foreign investments or loans.

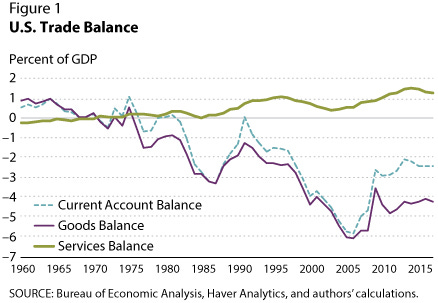

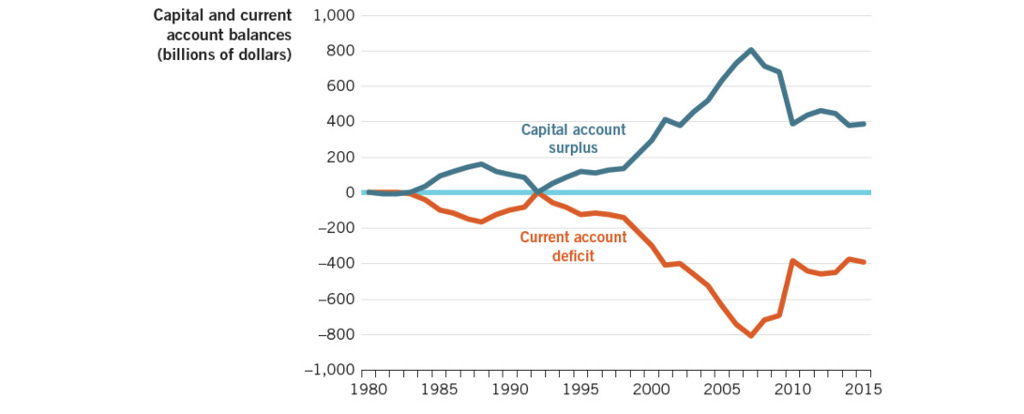

However, there is a major distinction between the two flows. This can be observed by looking at the balance of payments over time. There are two major components: the current account (which includes trade balance), and capital account (which includes cross border flows). Looking at how these graphs change over time can help ascertain which is driving what (and realize the velocity is not the same!). Another helpful graph is plotting the exchange rate (which is influenced by capital flows) against the trade balance over a period of time - as you can then observe how currency appreciation or depreciation impacts exports and imports.

Over the course of the last century, the key dynamic between the two have shifted throughout financial history, and it’s worth taking a close look at several examples. During each historical period, I determine the ‘winner’ of what was the dominant force that drove the monetary regime for its period.

The Gold Standard Era (1870s-1914)

Trade balance was the dominant leading mover. As countries had to settle trade imbalances with gold, this was a close-ended equation in which trade surplus/deficit were the primary determinant of cross border flows. Large trade deficits meant outflow of gold, which limited money supply and ability to influence rates and investments. Evidently, this means countries with deficits would experience tighter monetary conditions and a need to adjust domestic prices to restore balance. Winner: trade balance

The Interwar Period (1920-1940)

During this period, cross border flows dominated impact - and that’s mainly because after World War I, international capital flows became highly volatile. Some examples are the German hyperinflation in the 20s, where the value of the Reichsmark plummeted so quickly that price doubled within hours. There was the Austrian and Hungarian banking crises too, where Austria’s largest bank was a victim to foreign depositor outflows (Imagine SVB as an American, but death by foreigners). An one cannot avoid mentioning the British Pound Crisis, where the gold standard across Europe would be abandoned. Speculative capital flows were on the rise which created destabilizing forces, leading to various financial crises and currency issues. Capital flight and erratic movement in foreign investment made cross border flows dominant. Winner: cross border flows

Bretton Woods Era (1944-1971)

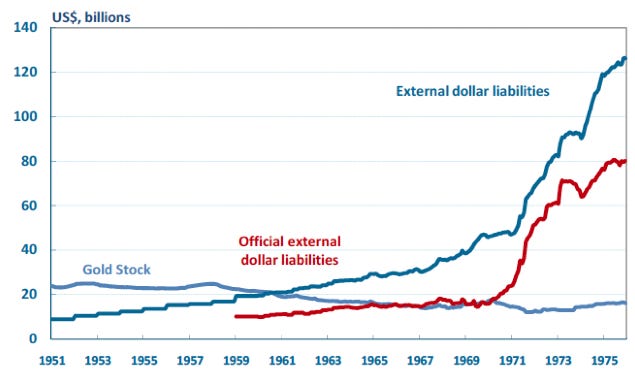

Initially it appeared as if trade balance was at the forefront. As the BW system established a fixed exchange rate regime, countries aimed at maintaining a balance of payment equilibrium, so cross border flows were highly regulated. But eventually in the later years, capital mobility increased dramatically and started to influence economies more especially as speculative pressure on currencies began to undermine fixed exchange rates. This of course would lead to the eventual collapse of the BW system. now well known and explained by the Triffin dilemma. The below graph also demonstrates US gold stock and external liabilities pre and post 1971. Winner: First trade balance, but eventually cross border flows

Post Bretton Woods era (1971-2000s)

After the world adopted floating exchange ranges, capital mobility surged and cross border flows became the primary drivers of exchange rates and trade balances. The liberalization of financial markets aided this dramatically, and it is during this period that economists truly learn how to weaponize reflexive cross border flows, particularly short-term capital movements, that can cause currency volatility that affect trade competitiveness, reversing the historical causality where trade flows influenced capital movement. More global economic history is starting to appreciate Japan as the greatest victim to this awakening.

In part, this is why the US always needs to run a trade deficit. As the dollar became a popular reserve currency, the US enjoys the ability to purchase foreign goods by simply issuing more debt. Winner: cross border flows

Globalization and Financial Integration (1990s-2008) and Post GFC (2008-2020)

This is the murkiest period. Increased financial integration meant cross border flows and trade balances became more interdependent. Massive capital flows faciliated trade imbalances - the post child of this dynamic represented between the US and China. As US trade deficit was financed by large inflows of from China and Japan, the symbiotic relationship took a turn. After GFC, capital flows sharply retreated and cause countries with large trade deficits to reassess the imbalance. Trade rebalancing naturally occurred as capital flows diminished. While the mainstream media sometimes frame this story in the other direction, capital flight from emerging markets in my opinion led to a mandatory requirement to change trade balance, especially as austerity measures were imposed upon deficit-led countries. Winner: unclear

Post COVID Era (2020+)

This is now where we are. In the wake of COVID, cross border flows have once again become the dominant force - especially through fiscal stimulus and monetary easing. Global supply chain disruptions and trade wars have made trade balance particularly volatile and uncertain to predict.

The below chart says it all. It might surprise many to know that the private sector / corporate credit is not the source of liquidity creation anymore, which has effectively been deleveraging since 2008. It’s actually all about the public credit: US deficit spending. Winner: cross-border flows

When you study these different eras, a particular trend emerges. Periods of tight monetary regimes (like gold standard or Bretton Woods), it is undeniable that trade balance influenced cross border flows more. In contrast, liberalized financial markets tend to be led by cross-border capital flows taking significant precedence. These periods seem to lead to a liquidity framework that is entirely driven by a debt-driven order.

The other conclusion to draw from this that these flows, then, tend to move cyclically. Some of that cyclicality would naturally come from the cadence of the refinancing norms, typically 5-7 years. As refinancing dominates capital formation relative to new issuance these days (some estimate at 3x), this implies shorter business cycles too. In contrast, capital expenditure towards fixed asset investments that drive trade balance changes have a much more longer cycle associated with the depreciation of such goods. In other words, the reason cross border flows are dominating impact over trade balance is simply the periodicity in which the financial markets operate rolling these refinancing investments.

The final conclusion therefore is that we are currently living in a period of extreme liberalization of the financial markets, but it is being led by the public sector, and not the private sector as in the recent past. In a way, that’s why the rise in interest rate hasn’t led to recessionary dynamics in the corporate market as pundits anticipated; the leverage is sitting elsewhere (hint: Japan). In that lens, it would appear to me that crypto serves a vital hedge for changes in liquidity conditions and framework. Whether crypto is correlated to the SPX or not is the wrong question; the right question is what is driving SPX that might or might not drive crypto the same way. And if you subscribe to the possibility that most of the world’s risk assets are pumping due to government driven cross-border flows being in the driver’s seat, then the right question to ask is: what is the exact opposite thing that I can own if the music stops?

What is “long” the idea of a restoration to a “trade balance”-driven world? I know my answer to that.